Funding Sources and the Importance of Diversity

What are funding sources?

Funding sources refer to the various ways in which the allied health organisation can receive financial income. These sources can come from a variety of places including:

- Medicare

- Department of Veterans Affairs (DVA)

- National Disability Insurance Scheme (NDIS)

- Private

- Work Cover

- Insurance

- Home care

packagespackage

The importance of funding source diversity

It is important for an allied health business to have a diverse range of income sources for several reasons including:

-

Relying on a single source of income can leave a business vulnerable to changes in the market, unexpected events, or shifts in consumer behaviour.

-

Diverse range of income sources can help to mitigate risk by providing a cushion against potential losses in one area.

-

For instance, if a business has multiple products or services, or sources of funding, and one of them experiences a decline, the other income sources may be able to compensate for the loss.

-

Having a diverse range of income sources can help a business to weather unexpected events or changes in the market.

-

If a business is heavily reliant on a single customer or client, and that customer or client experiences financial difficulties, the business may be at risk of suffering financial losses. However, if the business has multiple customers or clients, and one of them experiences difficulties, the impact on the business may be less severe.

Funding Sources on The BOS

Funding Sources appear in multiple reports such as:

- Mega Report for managers and key business stakeholders

- Practitioner Report for individual practitioners and their supervisors

In these reports you can break down certain metrics by Funding Source:

- Booked Hours, Billed Hours and other appointment-based metrics

- Revenue, Revenue Per Hour and other invoice-based metrics

This allows you to break down different areas of the business such as bookings or revenue by Funding Source.

A Practical Example

- Open an appropriate report by clicking on Mega Report or Practitioners ➡️ Practitioner Report

- Choose an appropriate time period (such as 'Monthly') or just leave the report in it's default 'Weekly' setting

- Find a metric you are interested in, perhaps Revenue and click on the Funding Source icon to show the Funding Source Breakdown.

- You can now compare the revenue by funding source over your selected time period to review business performance.

Understanding the data

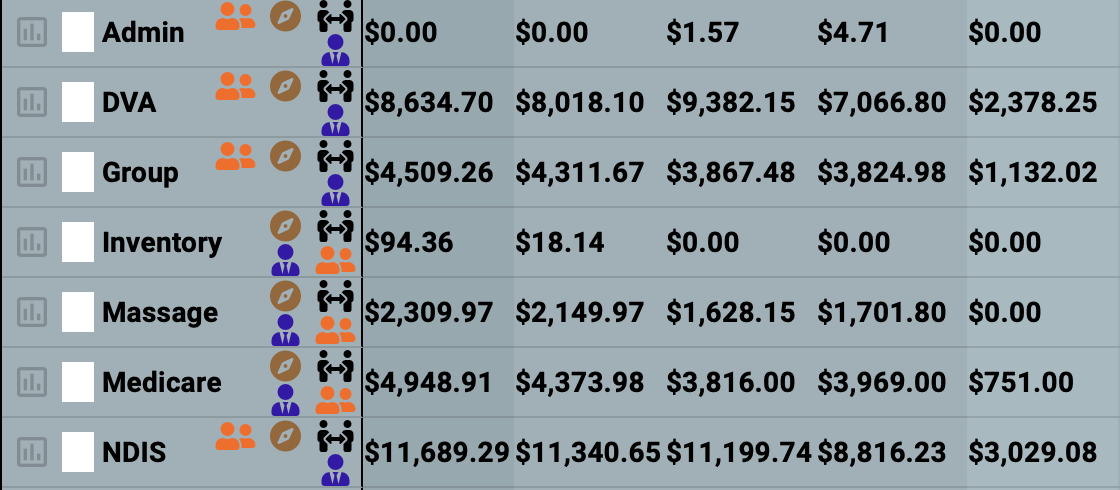

For example the image below is the funding source drop down for revenue over the last 5 weeks with the rightmost column being the current week.

Some at-a-glance insights are:

We are only part way through the current week, hence current week revenue is lower than previous (completed) weeks.

Some at-a-glance insights are:

- Inventory revenue has dropped from a high of $94.36 to zero for the last 3 weeks.

- NDIS accounts for approximately a third of all revenue on average. The business is hugely dependent on this one source

- DVA is a close second at nearly a third of revenue.

- Last Week vs Previous Week: Both DVA and NDIS revenue has dropped significantly, while other funding sources are performing consistently. This should be cause for concern

The importance of funding source diversity

It is important for an allied health business to have a diverse range of income sources for several reasons including:

-

Relyingona single sourceof income can leave a business vulnerable to changes in the market, unexpected events, or shifts in consumer behaviour.

Diverse range of income sources can help to mitigaterisk byprovidinga cushion against potential losses in one area.

For instance, if a business has multiple products or services, or sources of funding, and one of them experiences a decline, the other income sources may be able to compensate for the loss.

Having a diverse range of income sources can help a business to weather unexpected events or changes in the market.

If a business is heavily reliant on a single customer or client, and that customer or client experiences financial difficulties, the business may be at risk of suffering financial losses. However, if the business has multiple customers or clients, and one of them experiences difficulties, the impact on the business may be less severe.