Writing off invoices (BAD DEBT)

This information is only relevant if you are using The BOS Invoice Shipper and plan to write off bad debt

Writing Off Bad Debt

If you are using the Invoice Shipper then you need to ensure you are writing off debt using the correct procedure to ensure that the correct actions occur in Xero.

Why is this so complicated?

Nookal has the concept of invoices, payments and adjustments but does not support proper accounting/bookkeeping principles like credit notes, accounts etc.

Since Nookal doesn't have Credit Notes we can't write off bad debt the "proper" way like you would in Xero. Instead we have to do an adjustment to the invoice and use a "special keyword" to identify to The BOS that this adjustment is actually a debt write off and not a normal invoice adjustment.

We recommend using BAD DEBT as your keyword because that is the keyword Nookal refers to in their own debt write off documentation.

"GST Only" Bad Debt

Most bad debt you are writing off will be "normal" bad debt and you won't need to touch the 'Tax Bad Debt' fields.

If what you are writing off is 100% the GST component then use a separate code (We recommend BAD DEBT GST). This will write off the debt the same way as before but 100% of the write off will be allocated to the Tax Bad Debt Account.

This would most commonly be used if you requested a payment ($66) and only received the non-GST amount ($60) such as with a misconfigured DVA claim.

The adjustment names should be configured in The BOS before you start using them in your PMS, otherwise bad debt might not correctly be identified as it is classified as it comes in from your PMS.

PMS Settings

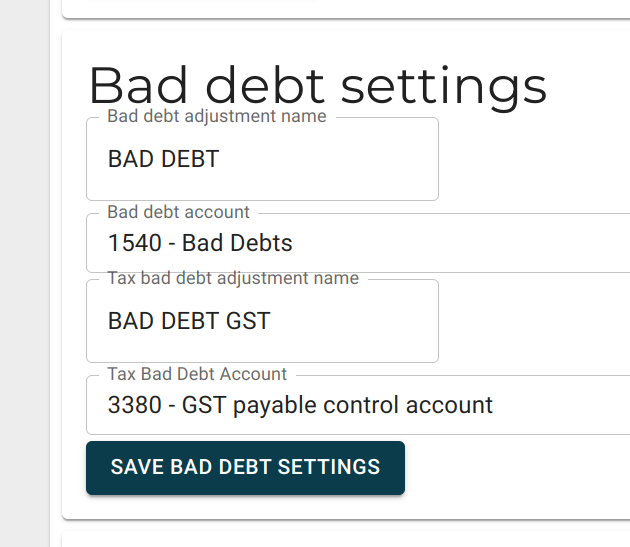

You can specify the following options:

| Setting | Description |

| Bad Debt Adjustment Name | Name that must be entered EXACTLY on all adjustments in your PMS to identify them as a debt write off (as opposed to a regular adjustment). We recommend BAD DEBT but you can use whatever you want. |

| Bad Debt Account | The expense account you use to represent bad debt in Xero. |

| Tax Bad Debt Adjustment Name | Adjustment description to use if writing off just the GST amount. (IE: asked for $66, received $60 from DVA). We recommend BAD DEBT GST |

| Tax Bad Debt Account | The Xero account managing GST payable (which will be reduced when Tax Bad Debt adjustments are made |